Get the free uc 1 form

Get, Create, Make and Sign

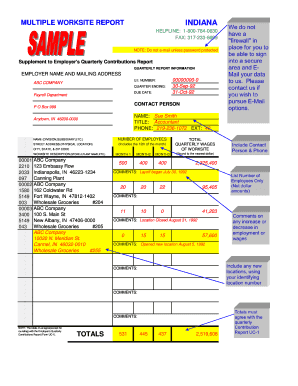

How to edit uc 1 form online

How to fill out uc 1 form

How to fill out Indiana form UC 1:

Who needs Indiana form UC 1:

Video instructions and help with filling out and completing uc 1 form

Instructions and Help about indiana form uc 1

Hi my name is Dr. Charles and the pretty lady next to me is one of my favorite patients Lori and between us is my dog Dolce now I've got somewhat of an unusual weight loss tip to share with you today a tip that's been right under our noses our whole life literally it's also one of the most important tips that I've shared with my patients in the clinic here in fishers Indiana it's a very simple tip that could help you quickly lose one to two inches from your belly and under a week now I need you to listen very closely this video contains one of my biggest fat burning secrets I don't know how long this video will be up, so please be sure to watch him from beginning to end well it's still here okay, so you're probably thinking to yourself listen I've tried every diet known to man I've given it my all and if I don't know it just keeps coming back well let me stop you right there this is not some magical weight loss pill it has nothing to do with that crazy-ass Albany garbage or any special weight loss drops or any of the other incredibly scamming weight loss gimmicks that we see all over the internet these days in fact these tips date all the way back to the 1950s and help explain why the majority of all Americans are now considered obese and know it might not be because we eat too many bad foods I'll show you how you should be able to eat some bad foods and still lose weight hey believe it or not it's not your fault, but before I get into the specifics let me quickly tell you a little about myself first I'm a board-certified chiropractic physician certified wellness practitioner certified advanced nutritionist speaker author have helped thousands worldwide one more thing before we go any further let me tell you about someone that I'm extremely proud of a patient of mine named Laurie now she was your typical working mom with three children to take care of yes I said three Laurie was my guinea pig at the beginning and helped me create this program now she comes from a very poor line of genetics obesity diabetes heart disease etc, so I thought if this program worked for it might be able to help anyone this one specific tip that I'm about to share with you helped Lori lose two inches from her belly lose eight pounds in only nine days lose two inches from each thigh lose three quarters of an inch from each arm dropped three dress sizes at the age of 30 she now wears a smaller dress than she did in high school I know you probably skeptical, and I don't blame you I mean it sounds like something so dramatic that it must be torn from one of those supermarket tabloids right, but it isn't Lori ultimately lost a whopping ninety pounds of fat and dropped 16 dress sizes 16 Lori went from these 210 pounds which by the way is the way that she couldn't get rid of after her last pregnancy to these 120 pounds, and she achieved all of this without counting calories without starving yourself without killing herself at the gym all while still eating all the foods that...

Fill blank uc1 form for indiana workforce : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your uc 1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.